35 & 40 Year Mortgage Canada Calculator

35 Year Mortgage Calculator Canada

Canadian Mortgage Calculator for Vancouver Real Estate with Amortizations up to 40 Years

I am both a property owner in Vancouver and a Realtor.

I constantly watch the mortgage market here in Canada to see how changes to mortgage interest rates and amortization affect both the Vancouver real estate market and my personal real estate holdings.

Ultra-low mortgage rates originally focused my mind on mortgages as have the more recent higher interest rates being charged.

One of the things I use online A LOT (OK, compulsively, all the time) is a mortgage calculator, so I thought I would have my own built to share.

Are Online 40 Year Mortgage Calculators Useful?

Consistently finding a good Canadian mortgage calculator that could work for both investors and owner occupiers was quite frustrating for me.

In using online mortgage calculators I noticed that many of the calculators I found are specific to the US and not Canada.

This mortgage calculator you see above is proudly Canadian and Canadian made!

Among the Canadian mortgage calculators, I also noticed that they could not do long amortizations out to 40 years.

This 40 year mortgage calculator is designed to fix that.

Why are 40 Year Amortizations on this Mortgage Calculator?

In the Spring of 2011, Canada’s Department of Finance changed the amortization rules so that INSURED mortgages could not have an amortization longer than 35 years.

But keep in mind, that is ONLY for mortgages INSURED by the CMHC which are at 80% loan to value (ie a property where the mortgage is less than 80% of the properties value, like a property worth $1 that has a mortgage on it for $.80 or less).

Are 40 year Amortizations allowed in Canada?

YES! (please confirm with a qualified mortgage specialist)

Mortgages that are the low ratio (ie less than 80% loan to value) amortizations of up to 40 years are still allowed!.

These longer amortizations can be useful and powerful for investors (but are not for everyone!).

The rarity of decent Canadian Mortgage Calculators with amortizations of up to 40 years is a major reason I had this calculator set up on my site.

I would love to hear your thoughts and comments on this Canadian Mortgage Calculator that is good for amortizations out to 40 years!

Please contact us with questions on 40 year mortgages.

40 Year Mortgage Calculator – How to Use It

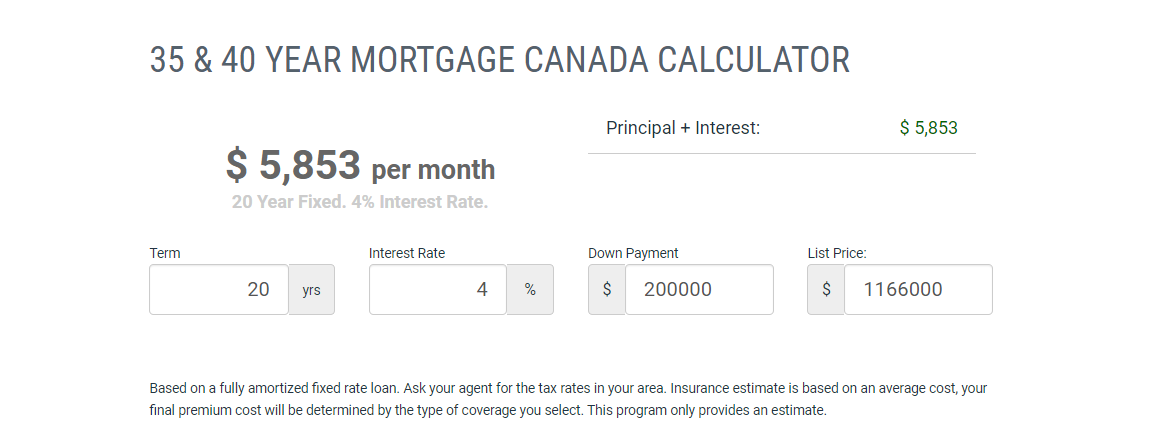

As you may have noticed there are two calculators for mortgages. Both will do up to 40 year amortizations. The upper calculator is a simpler and newer version.

The first mortgage calculator is fairly self explanatory.

Just fill in the following for the monthly mortgage payment you want to calculate:

- Mortgage Term

- Interest Rate

- Down Payment

- List Price

and the monthly payment for the sums inputted will appear with out having to press calculate. (see below for an example of what to expect)

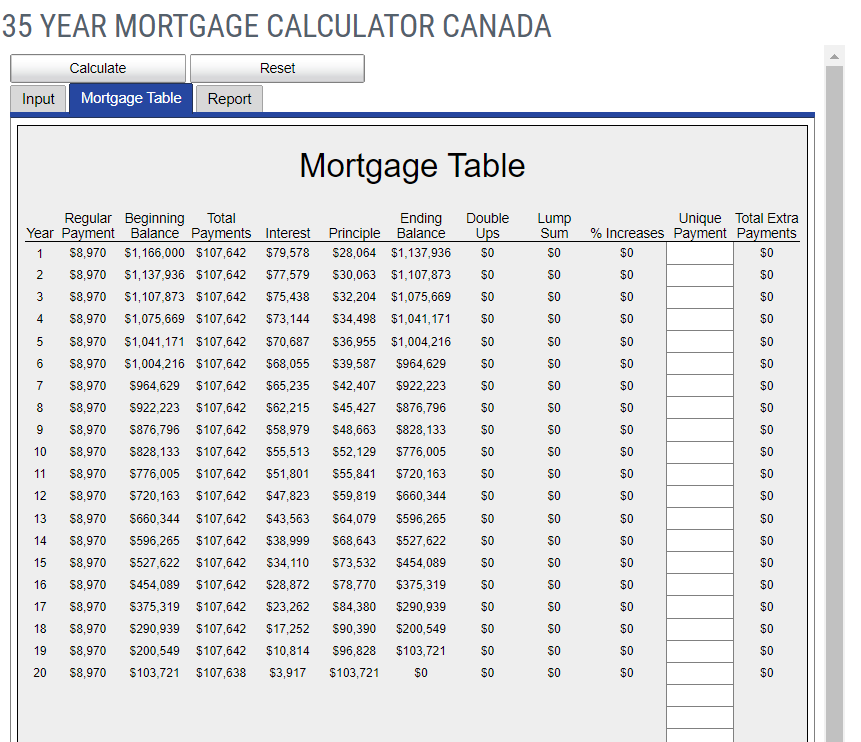

For the lower calculator, a higher level of detail is available with a mortgage chart showing exactly how much principal and interest is paid over time by clicking on the button “Mortgage Table” once you have inputted the date and hit “Calculate” (see below)

This calculator will show you the following:

- Interest payments per month and year

- Principal paydown per month and year

- Total interest

- And how a 40 year term or other amortization will affect principal and interest paid as well as the payment.

Should you have any questions or issues using this calculator, feel free to call me directly at 604-763-3136.

FAQ for the Canada Mortgage Calculator with 35 & 40-Year Amortizations

-

What is a 40-year mortgage?

- A 40-year mortgage is a home loan that is amortized, or spread out, over 40 years. This means that the loan payments are calculated as if you’ll pay off the loan over 40 years, resulting in lower monthly payments compared to shorter-term mortgages. Please note – a 40 year loan or mortgage may result in lower payments on a monthly basis, but will result in much higher total interest costs.

-

Is a 40-year mortgage available in Canada?

- Yes, 40-year mortgages are available in Canada. However, there are specific conditions. For instance, mortgages that have a low ratio (less than 80% loan to value) can have amortizations of up to 40 years. It’s essential to understand the terms and conditions associated with such long-term mortgages.

-

How does the 35-year mortgage calculator for Canada on this page work?

- The 35-year mortgage calculator for Canada on this page allows users to input their loan amount, interest rate, and other relevant details to calculate their monthly payments for a 35-year amortization period. It provides an estimate for both principal and interest, giving users a comprehensive view of their potential mortgage costs.

-

Why would someone choose a 40-year mortgage in Canada over a shorter-term mortgage?

- A 40-year mortgage in Canada offers the advantage of lower monthly payments since the loan amount is spread over a more extended period. This can be beneficial for those who prioritize lower monthly expenses. However, it’s essential to note that you might end up paying more in interest over the life of the loan compared to shorter-term mortgages.

-

Are there any specific considerations for the Vancouver real estate market when it comes to 35 and 40-year mortgages?

- The Vancouver real estate market, like other markets, is influenced by mortgage interest rates and amortization periods. Longer amortizations like 35 and 40 years can impact both the market and individual real estate holdings, especially with the dynamics of ultra-low mortgage rates. It’s always recommended to consult with a local Realtor or financial advisor to understand the implications fully.

-

How accurate is the 35-year mortgage calculator for Canada on this page?

- The calculator provides an estimate based on the inputs provided by the user. While it’s designed to be as accurate as possible for general scenarios, individual circumstances, tax rates, and insurance estimates can vary. It’s always a good idea to consult with a mortgage professional for precise figures.

We hope this FAQ provides clarity on 35 and 40-year mortgages in Canada and the utility of the calculator on this page. If you have further questions, it’s recommended to reach out to a mortgage or real estate professional for guidance.

Worried about Buying a Nightmare Condo in Vancouver?

Check out this great post on How To Avoid Leaky Condos!

Thinking of Getting a Mortgage on a Presale Condo in Vancouver?

Check out this great video on Mortgages for Presale Condos in Vancouver!

The formula in this mortgage calculator is inserted correctly, and the calculator works quite well. I am going to enter all the data that I have currently and I hope that I get the right mortgage. That would be best for me.

Which lenders in Ontario allows 40 years amortization, do they do it on refinances? Thanks

Hi Zyrene,

Good to hear from you.

Not sure about Ontario.

Would you like me to put you in touch with a mortgage broker?

Thanks!

Says 40 yr. max. but I punched in 50 and it actually did a calculation.

Just checking cause there was a builder offering VTB w/50 yr amort.

I was playing with the numbers.

I did find another online site that did 50 but the payments come out way higher than this calculator.

Strange.

Hi Carla,

Good to hear from you.

Thanks for that feedback.

I did not know the calculator worked for 50 year amortizations.

Very cool!